Navigate Foreign Markets: Currency Exchange in Toronto Simplified

Expert Tips on Browsing the Money Exchange Market Successfully

Browsing the money exchange market can be an intricate undertaking, especially for those looking for to maximize their returns while lessening risks. From decoding market fads to adjusting to crucial variables affecting exchange prices, there are critical maneuvers that experienced experts use to remain in advance of the curve.

Comprehending Market Patterns

To browse the money exchange market effectively, it is necessary to have an eager understanding of market fads. Market patterns describe the general instructions in which the marketplace is conforming time. By evaluating these trends, traders can make even more educated choices about when to acquire or sell money. One key facet of recognizing market trends is recognizing whether a currency is valuing or diminishing in worth about others. This information can assist traders anticipate possible market movements and change their strategies as necessary.

Keeping an eye on economic signs, political events, and global information can offer useful understandings into market fads. For example, a country's rates of interest, GDP development, rising cost of living prices, and political security can all influence its money's stamina on the market. By staying educated concerning these variables, investors can better interpret market fads and make strategic trading choices.

Trick Aspects Impacting Exchange Rates

A comprehensive understanding of the key factors influencing currency exchange rate is essential for navigating the intricacies of the currency exchange market properly. Currency exchange rate are influenced by a wide variety of variables, with some of the most substantial ones being rate of interest rates, rising cost of living, political stability, financial performance, and speculation.

Rates of interest play an important duty in establishing exchange rates. Nations with greater rate of interest often tend to draw in more foreign capital as a result of greater rois, bring about a gratitude of their currency. Conversely, reduced interest prices can lead to money depreciation.

Rising cost of living is another essential element impacting currency exchange rate. currency exchange in toronto. Nations with lower rising cost of living rates usually see an appreciation in their currency worth as their acquiring power rises

Political security and financial efficiency likewise effect currency exchange rate. Nations with steady governments and strong financial performance typically have stronger currencies as they are seen as safe sanctuaries for investments.

Conjecture in the forex market can likewise cause fluctuations in exchange rates. Capitalists and investors anticipating future currency movements can create sudden changes in exchange prices. Recognizing and assessing these crucial aspects can help services and individuals make educated decisions when handling fx transactions.

Establishing a Strong Trading Strategy

Understanding the key elements affecting exchange prices sets the foundation for crafting a solid trading method in the dynamic currency exchange market. When you have an understanding of exactly how various factors affect currency exchange rate movements, you can start to establish a critical technique to trading money efficiently.

A strong trading strategy commonly involves setting clear objectives, establishing danger monitoring methods, and carrying out detailed market evaluation. Establishing particular revenue targets and stop-loss degrees can help you stay disciplined and stay clear of emotional decision-making during professions. Additionally, incorporating technical evaluation devices and staying informed concerning international financial events can supply useful understandings for making informed trading decisions.

In addition, pop over to these guys diversification across various money sets and time frames can help spread out threat and optimize trading opportunities. It is important to continuously assess and change your trading approach based upon market problems and performance evaluation. By creating a well-thought-out trading method that straightens with your threat resistance and monetary objectives, you can boost your opportunities of success in the money exchange market.

Leveraging Modern Technology for Analysis

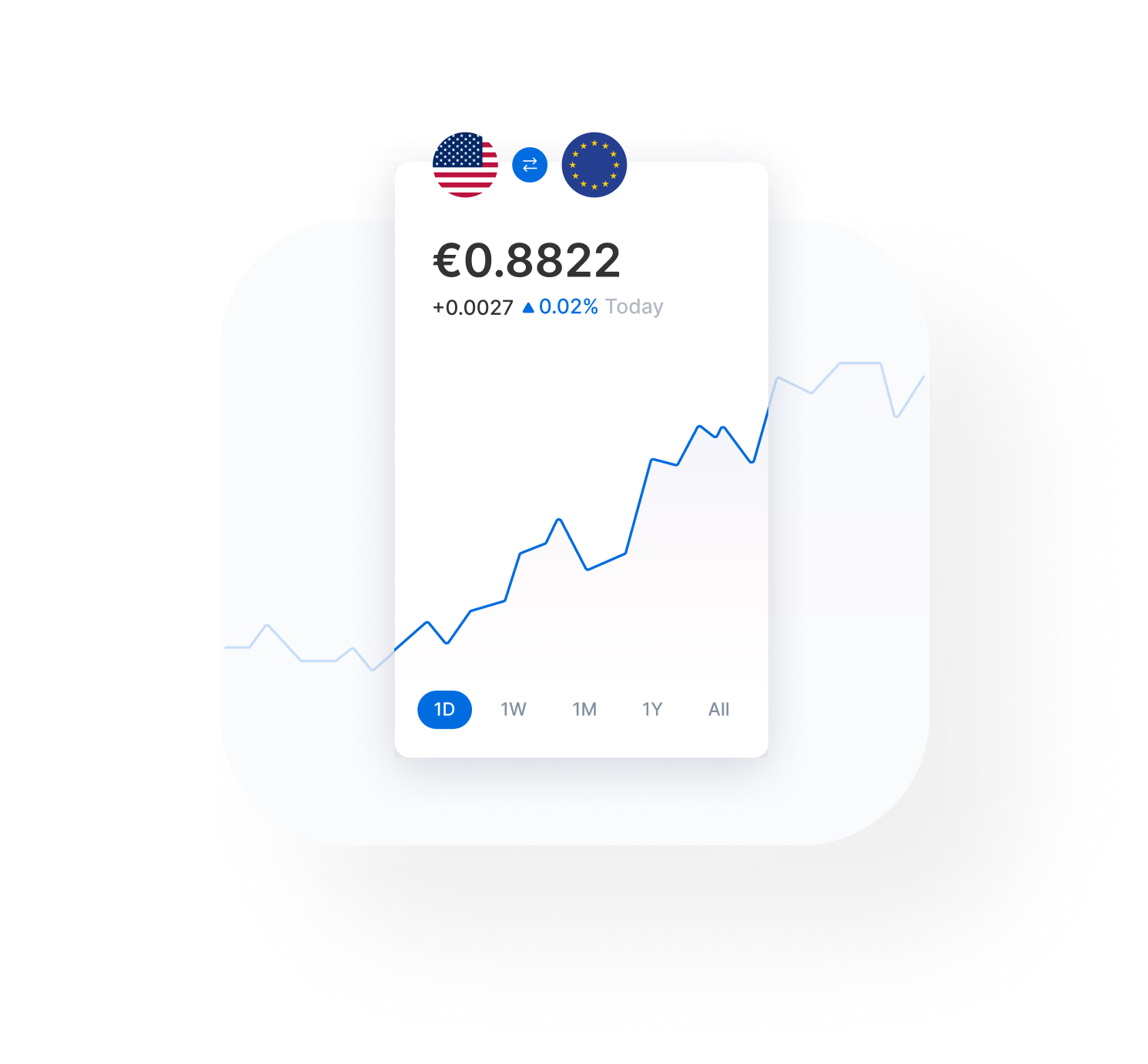

Integrating sophisticated technical devices can dramatically improve the accuracy and performance of market evaluation in the money exchange industry. Making use of innovative algorithms and data analytics software application can supply investors with useful understandings into market trends, cost motions, and possible chances. These devices can help in carrying out comprehensive technological evaluation, identifying vital assistance and resistance degrees, and anticipating future rate movements with better accuracy.

Moreover, leveraging modern technology for analysis enables traders to automate trading approaches based upon pre-programmed specifications, aiding in performing trades swiftly and efficiently. By utilizing trading systems with innovative charting functions and real-time information feeds, traders can make enlightened choices promptly, optimizing their opportunities of success in the money exchange market.

Handling Risk and Protecting Investments

To properly wikipedia reference navigate the currency exchange market, Get More Information prudent danger management strategies are important for guarding investments and ensuring long-term success. One fundamental way to take care of risk in the money exchange market is via diversity. By applying these danger management methods, capitalists can minimize prospective downsides and shield their financial investments in the money exchange market.

Final Thought

In verdict, navigating the currency exchange market efficiently needs a deep understanding of market fads, essential aspects affecting currency exchange rate, and the advancement of a strong trading approach. Leveraging technology for evaluation and managing risk are vital for safeguarding financial investments. By staying educated and carrying out efficient techniques, traders can boost their opportunities of success in the currency exchange market.

By accepting modern technology for analysis, traders can stay in advance of the contour and make even more informed trading decisions in the vibrant money exchange market.

In conclusion, navigating the currency exchange market successfully requires a deep understanding of market trends, crucial elements influencing exchange rates, and the growth of a strong trading strategy.